Although there are rumours that APW Asset Management Ltd, who offered

Australian wines as an investment, is headed for liquidation. This has not been confirmed by Quantuma LLP, who are handling APW's affairs.

In response to my asking yesterday what the current status of APW Asset Management Ltd Quantuma LLP replied: 'At this moment we cannot confirm anything regarding the above case'. I'm promised an update when they are able 'to release some information'.

In response to my asking yesterday what the current status of APW Asset Management Ltd Quantuma LLP replied: 'At this moment we cannot confirm anything regarding the above case'. I'm promised an update when they are able 'to release some information'.

Clients of APW Asset Management Ltd received a letter in December from Chima Maduabuchukwu, the company’s now sole director, telling them that ‘we will no longer be advising and managing your day to day and will be passing all management of APW affairs to Quantuma LLP of 81 Station Road, Marlow, Bucks, SL7 INS.’

The phones at APW Assessment Management Ltd are not being answered instead there is a message that the mailbox is full.

Wines for APW clients are stored at London City Bond in numerous sub-accounts. LCB have frozen the whole APW Asset Management Ltd account as substantial storage charges are overdue. David Hogg at LCB’s Vinothèque said: “I’m sure the amount owed will be sorted out but is just a question of playing the waiting game.”

“A number of APW clients have told us that they paid their storage charges at the end of last year,” said Hogg. “However, APW has not passed these on to us.”

Given that APW Asset Management Ltd appears not to be currently functioning and that the sum owed to LCB is some six figures, liquidation would now appear to be more likely than administration. Furthermore as monies paid over to APW for storage at LCB by their clients appears not to have been passed over, this raises the question of whether all of the wines ordered recently by investors have been purchased.

Avoid UK Agora Ltd

At least one APW client has been approached by Jamie Ellis of UK Agora Ltd offering to sell them wine as they ‘are more reputable than APW’. UK Agora Ltd was set up in April 2014. Ellis was previously a broker with APW. On 22nd January 2015 Ellis offered £2500 for six bottles of 2009 Penfolds Grange including a 10% brokerage fee. wine-searcher shows that a six bottle case can be bought for £1560 from Berry Bros & Rudd. Today UK Agora Ltd's website has disappeared. Let's hope it stays down!

At least one APW client has been approached by Jamie Ellis of UK Agora Ltd offering to sell them wine as they ‘are more reputable than APW’. UK Agora Ltd was set up in April 2014. Ellis was previously a broker with APW. On 22nd January 2015 Ellis offered £2500 for six bottles of 2009 Penfolds Grange including a 10% brokerage fee. wine-searcher shows that a six bottle case can be bought for £1560 from Berry Bros & Rudd. Today UK Agora Ltd's website has disappeared. Let's hope it stays down!

Six bottles of 2009 Grange for £2500 from UK Agora Ltd

including 10% brokerage fee

now Nicholas Gibbs is apparently with UK Agora Ltd

If the price of the 2009 Grange is any indication, UK Agora Ltd would appear to be following on with the investment pricing policy of APW Asset Management Ltd. Lionel Nierop of Bid for Wine has told investdrinks of a client of APW who a few years ago invested over £300K in Australian wines but was only able to realise around £60,000. A rule of thumb Nierop says investors can reckon to get back 20p in a £1 on their APW Australian investments at auction. This assumes that the wines are auctioned in bond.

APW Asset Management Ltd was set up in December 2002. It was originally called Australian Liquid Assets Ltd, changing its name to Australian Portfolio Wines (UK) Ltd in early 2003. In early 2013 the company name was changed APW Asset Management Ltd.

APW Asset Management Ltd has been run by a number of directors including Arlene King (July 2008 to December 2010), who was also the company secretary from July 2005 to December 2010. King has been a director of The Bordeaux Wine Company, another wine investment company, since January 2005 and is currently its sole director. Both companies have the same registered office in Kenton.

41-year-old Frederick (Freddy) Achom is the senior partner and major shareholder in The Bordeaux Wine Company and a founder and chairman of The Rosemont Group. Achom has had a chequered career. In 2010 and 2011, according to Wikipedia, Achom was included in the Evening Standard’s list of 1000 most influential Londoners. He has also been listed as one of the UK’s Most Influential Black People. Wikipedia reports that: 'In 2012 his Rosemont Group’s wine asset management subsidiary companies, which span the UK, Australia and China, were reported to have over 50 million pounds of wine assets under management.'

However, back in September 2000 Frederick Achom was sentenced at Southwark Crown Court, London to a year’s imprisonment for fraud. He, along with Anthony Grant, were barred from being UK company directors from July 2002 to July 2013. His first wine investment company – Boington and Fredericks Ltd – was closed in the public interest in January 2002.

Chima Madu's Global Bordeaux site

The Bahamas Connnection

Chima Maduabuchukwu, also known as Chima Madu, is APW’s sole director (appointed August 2014) and is based in the Bahamas. He also runs Bahamas-based Global Bordeaux, a wine investment company, set up in 2013. Its address is: Suite 1A Regent Center, West Explorers Way, Freeport, Grand Bahama, Bahamas P.O.Box F-40337. Chima Maduabuchukwu's Bahamas address is Centre Suite, 1A Regent Center, West Explorers Way, Freeport, Grand Bahama, Bahamas F-40 393.

Chima Maduabuchukwu, also known as Chima Madu, is APW’s sole director (appointed August 2014) and is based in the Bahamas. He also runs Bahamas-based Global Bordeaux, a wine investment company, set up in 2013. Its address is: Suite 1A Regent Center, West Explorers Way, Freeport, Grand Bahama, Bahamas P.O.Box F-40337. Chima Maduabuchukwu's Bahamas address is Centre Suite, 1A Regent Center, West Explorers Way, Freeport, Grand Bahama, Bahamas F-40 393.

Regent Centre Suite 1a Regent Centre, Explorers Wa

Freeport

Grand Bahama

Bahamas

F-40 393

Read more at: http://companycheck.co.uk/director/919051387

Read more at: http://companycheck.co.uk/director/919051387

Its website claims: 'At Global Bordeaux we use our expertise to successfully navigate the fine wine market for investors seeking growth and stability.' Wines are stored at London City Bond.

Chima Madu was previously a director of the now dissolved Rosemont Overseas Investments Ltd (formed 5.8.2008). At the time Rosemont Overseas Investments Ltd was set up Chima Maduabuchukwu's address was 28D Fitz John's Avenue, London NW3 5NB.

His fellow director was 42-year-old Dean Achom (DOB: 9.8.1972). Dean Achom has been a director of several companies including Rosemont Marketing Ltd that was formed in 7.12.2001 and dissolved 17.3.2009. Achom was a director from 22.1.2005 to 17.3.2009.

Who I wonder decided to appoint Chima Maduabuchukwu as the sole director of APW Asset Management?

APW Shareholders

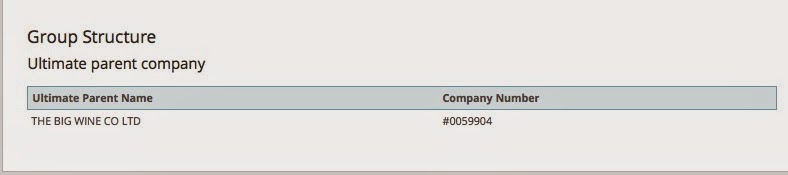

APW Asset Management Ltd has £100 of issued share capital. The parent company is The Big Wine Company, which is not registered in the UK. It's registration number is #0059904. Somewhere off-shore? Is there perhaps a possible clue in its initial letters – BWC?

Share capital: £100 – 5% held by Enzo Giannotta

and 95% by Big Wine Company Ltd

Ultimate parent company: The Big Wine Company Ltd

Not registered in UK. No: #0059904

More to come as story unfolds ....

See the fine investigation by Neal Baker in The Drinks Business on APW.

ROSEMONT MARKETING LIMITED

Read more at: http://companycheck.co.uk/company/04335965/ROSEMONT-MARKETING-LIMITED/directors-secretaries

Read more at: http://companycheck.co.uk/company/04335965/ROSEMONT-MARKETING-LIMITED/directors-secretaries

No comments:

Post a Comment